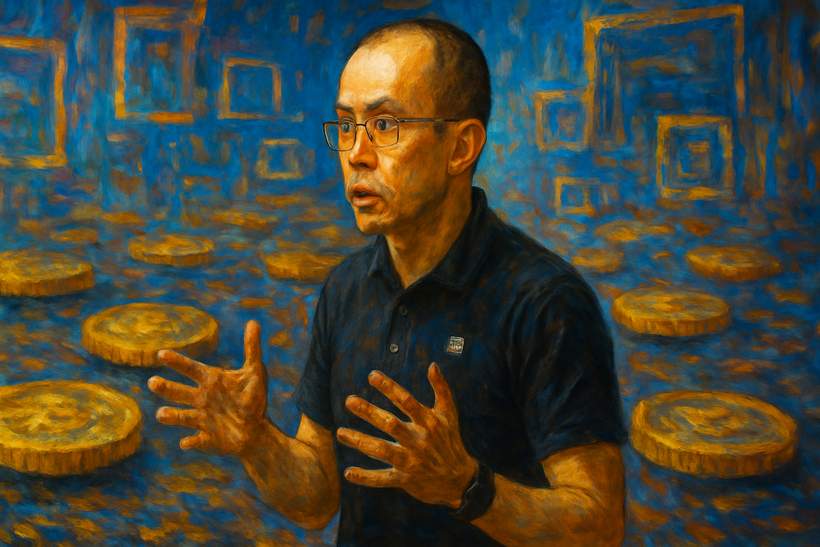

CZ Says Aster’s Privacy Beats Hyperliquid’s Transparent Order Books

CZ Chats About Chinese Memecoins

So, Changpeng Zhao, the vibe master himself, recently took a deep dive into the wild world of Chinese memecoins on the BNB Chain. During a humorous exchange on CounterParty TV, he explained how Aster’s covert orders give it a leg up over Hyperliquid’s oh-so-transparent order books. Spoiler alert: This guy’s got opinions!

The Great Meme Explosion

Zhao’s musings took a turn towards the whimsical imagery of the Mid-Autumn Festival, when he accidentally ignited a meme bonanza just by saying, “Happy Mid-Autumn Festival, post your best memes!” Apparently, the crypto community took him seriously and flooded the place with moon-themed memes and some cheeky references to Zhao’s name—how poetic!

Holder Vibes Over Trading Swings

Here’s the kicker: five BNB Chain memes have recently inflated to market caps ranging from $100 million to $500 million! Zhao remarked that BNB traders are more about holding onto their treasures (like dragon hoarders) compared to the fast-paced culture of Solana traders who seem to live for the ups and downs of meme trading.

Busting the Closed Ecosystem Myth

Now, if you think BNB is a closed-off operation, think again! Zhao pushed back on this misconception, claiming their ecosystem is more open than the exclusive club that is Solana. “We list tokens from every blockchain, even those funky meme coins!” Trust Wallet covers a variety of blockchains, while some other platforms play favorites, leaving BNB to bask in its diversity.

The Law and Meme Coins

Zhao also explained how the SEC’s lawsuits targeting utility tokens around the time of Joe Biden’s presidency pushed some projects toward simpler (and less legally dodgy) meme coins. Less utility means fewer lawyer issues, so why not just declare your coin as all about the vibes?

The Privacy Debate

Speaking of vibes, Zhao’s leading lady, Aster, comes from two decades of trading experience that scream the need for privacy. His point? Hyperliquid’s transparent order book might just be too risky for the Wall Street wizards:

“Every single trader I’ve chatted with hates the idea of everyone watching their every move in real-time. If others can peek at your trades, the game’s rigged against you!”

Aster’s Rise

After Zhao’s privacy rants, 30 projects pitched him that very day! Aster’s secretive orders caught the eye of Binance Labs and other privacy-focused projects, making waves in the DEX world.

Looking Ahead

No privacy means your trading strategy is an open book, ripe for exploitation! Zhao’s got ideas for the future, too. Though he admits Hyperliquid could catch up on privacy features, he emphasizes an exchange’s real test lies in how they shield their users and tackle mishaps.

Centralized Vs. Decentralized: What’s Next?

In a wild prediction, he also thinks perpetual DEXs will one day compete with centralized exchanges (CEXs). His thought process: first, users will come for the familiar interfaces of CEXs, but eventually, they’ll migrate to DEXs for a wider selection and earlier token access.

“In 20, 30, 50 years, everything’s on-chain! Until then, CEXs will adapt and improve for the new wave of traditional user excitement—after that, it’ll slowly drift back to the DEX world!”

Meet the Content Kings

On to the authors: Gino Matos, a law school graduate and seasoned crypto journalist, knows the Brazilian blockchain scene like the back of his hand. Then there’s AJ, a journalist who’s been through the wringer since Yemen’s 2011 Arab Spring, now focusing on the ever-changing landscape of crypto.

Final Thoughts

Remember, folks, this blog is just a peek into the crypto cosmos! Don’t take it as investment advice—use that brain of yours! Just stay savvy when trading cryptocurrencies, as it can be a rollercoaster ride of risk!

Disclaimer: The opinions expressed here are purely those of our writers and don’t reflect the views of CryptoSlate. Always do your own research before jumping into any crypto fads!